Good! Why Does Volatility Increase Option Value

This is because call buyers are not. The stock is about to rebound and because higher stock prices mean higher option prices for calls there is a kind of synergistic effect to the rising price of.

Delta Explained The Options Futures Guide

Yes volatility is an important factor that determines the prices of any Options.

Why does volatility increase option value. Volatility goes up for both puts and calls as well. Therefore falling stock price causes the put options on the stock to go up in value which in turn causes the implied volatility of the stock to increase. The Price-Volatility Relationship.

Volatility is denoted as VEGA this is one of the 4 geeks in Options. The Cboe Volatility Index VIX detects market volatility and measures investor risk by calculating the implied volatility IV in the prices of a basket of put and call options on the SP 500. Our no-arbitrage modelfor stock index returns as well as for equity and volatility option pricesextends the one-factor stochastic volatility.

Implied volatility is the markets measure or anticipation of how volatile the movement of the underlying equity will be during the lifetime of the option contract being bought or sold. In fact implied volatility is itself a proxy for option price. Generally speaking if implied volatility decreases then your call option could lose value even if the stock rallies.

Increase the density in the payoff region for out-of-the-money options thereby increasing their theoretical value. Implied volatility tends to increase when options markets experience a downtrend. Most traders who sell options are wary of a stock market crash or a severely falling market.

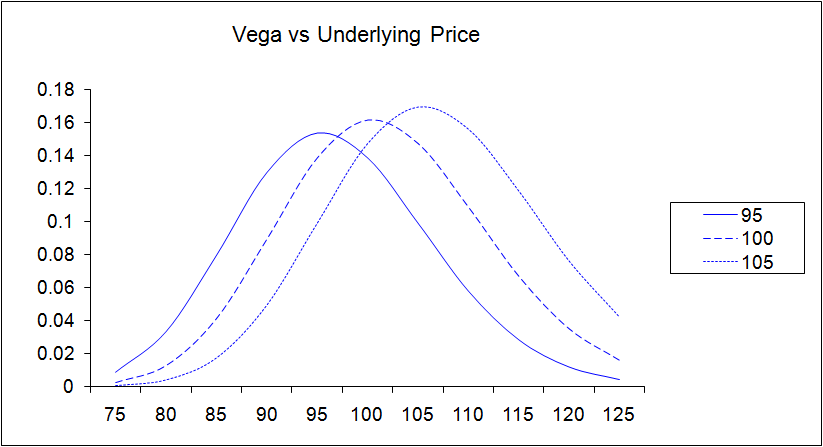

Answer 1 of 7. Answer 1 of 7. The vega specifies the change in value of the option for a 1-percent change in implied volatility.

Implied volatility falls when. The higher the overall implied volatility or Vega the more value an option has. Volatility-of-volatility risks are also a significant risk factor which affects the time-series and the cross-section of index and VIX option returns above and beyond volatility risks.

When markets go up there is less hedging and thus less demand so volatility goes down and prices of both puts and calls go down. What I dont understand is why this increased volatility on both the low side of the average and the high side make the option more expensive to purchase. 4 Rising interest rates will cause calls to increase in value and puts to fall in value.

When a firm has options this increase in equity value is shared between the stock and options. For instance Delta is a measure of the change in an options pr. Remember that at the end of an options life there are only two possible outcomes for its value on the day of options expiration.

Simply put Implied Volatility provides way to roughly find one standard deviation move of the stock price in next one year. 2 As volatility rises call and put value rise and vice versa. If the interest rates increase by 1 then the call option price will increase by.

3 As we approach expiration Friday time passes call and put value fall. Expressed as a dollar value it measures how much the price of an option moves in response to volatility of the underlying asset. We can use the vega to determine the potential of an option to rise in value.

Dividends increase the attractiveness of holding stock rather than buying calls. As per the Black-Scholes model the value of a call option is directly proportional to the volatilityWithout getting into the derivation of the BS equation is it possible to intuitively understand why this is so. Then more volatility means the stocks distribution gets more upside without suffering a greater probability of ending out of the money.

Consequently an increase in firm volatility increases equity value by reducing debt value Black and Scholes 1973. To summarize you can buy an option ahead of a news event but if you do you are probably buying at inflated prices due to a volatility increase. First lets clarify what an implied volatility means then we can dig deeper into why and how it impact option prices What is Implied Volatility.

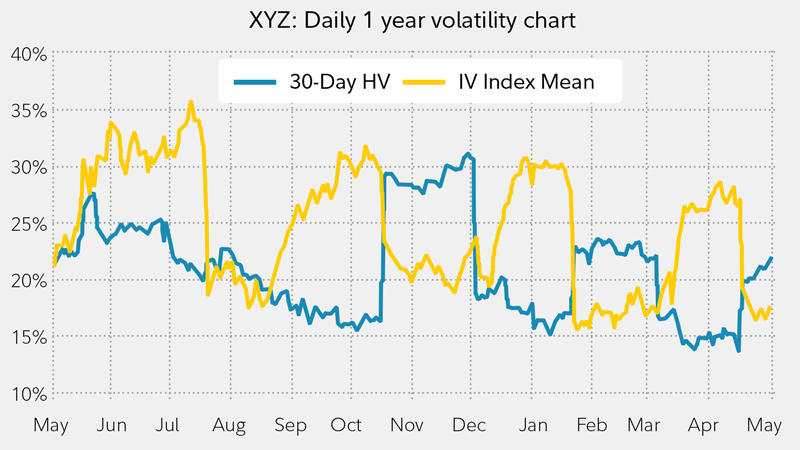

As Figure 1. 1 As the stock price rises the call value rises and the put value falls and vice versa. Implied volatility is the real-time estimation of an assets price as it trades.

As can be seen from the above points it is only volatility that impacts call and put options in the same direction. Assuming your option was worth 030 due to probabilities and not high risk-free rates r more volatility will increase its value. An options Greeks describes its various risk parameters.

Assume that a call option is currently priced at 5 and has a rho value of 025. As you can see the underlying has collapsed and volatility has increased considerably. A price chart of the SP 500 and the implied volatility index VIX for options that trade on the SP 500 shows there is an inverse relationship.

Limited liability implies that equity is an option on firm value with a strike price equal to the face value of debt. Generally speaking increased volatility will. In fact put options increase in value when the underlying goes down.

Furthermore the increasing volatility would increase the price of the put option purchased. Ad Real-time implied volatilities greeks scenario analytics and PL impacts. High volatility just means the underlying stock is volatile it does.

I can understand that volatility increases the value of an option when a stock is outat the money. An increase in the volatility of the stock increases the value of the call options and also of the put option. On the low side I see it.

/ImpliedVolatility_BuyLowandSellHigh2-2f5a33f6dde64c808b4d4775a258d3d7.png)

Implied Volatility Buy Low And Sell High

Delta Explained The Options Futures Guide

What Is Implied Volatility Ally

Volatility Arbitrage Overview How It Works And Concerns

Theta Explained The Options Futures Guide

Gamma Explained The Options Futures Guide

Take Advantage Of Volatility With Options Fidelity

:max_bytes(150000):strip_icc()/OptionPrice-VolatilityRelationship_AvoidingNegativeSurprises2-7c29ee4470f64718b957ff917e9380c1.png)

Option Price Volatility Relationship Avoiding Negative Surprises

The Options Industry Council Oic Delta

:max_bytes(150000):strip_icc()/ImpliedVolatility_BuyLowandSellHigh2-2f5a33f6dde64c808b4d4775a258d3d7.png)

Implied Volatility Buy Low And Sell High

Option Price Volatility Relationship Avoiding Negative Surprises

/ImpliedVolatility_BuyLowandSellHigh2-2f5a33f6dde64c808b4d4775a258d3d7.png)

Implied Volatility Buy Low And Sell High

Option Price Volatility Relationship Avoiding Negative Surprises

Introduction To Options Pricing And Implied Volatility Iv By Cryptarbitrage Deribit Official Medium

Option Trading School What The Heck Is Vega And Do I Need To Care

Volatility And Implied Volatility

Introduction To Options Pricing And Implied Volatility Iv By Cryptarbitrage Deribit Official Medium

Volatility And Implied Volatility

Comments

Post a Comment